Security

Decentralized vs Centralized NFT Marketplaces

The Pros and Cons of Centralized and Decentralized NFT Marketplaces

The NFT market is exploding, but the industry’s ethos of decentralization and end-user prioritization is being undermined by the current infrastructure. User interactions and trading have always been limited in this sector, with largely barebones applications and exchanges supporting it thus far.

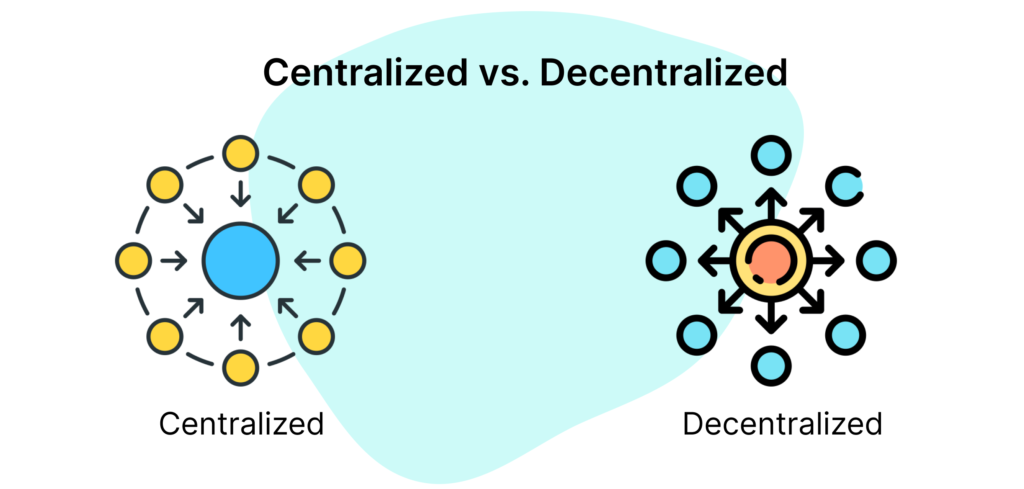

What are Centralized and Decentralized NFT Marketplaces?

A centralized system is one in which the data and operations of a platform are controlled by a central authority. Centralized systems, in essence, administer the platform from a single location with a singular point of failure.

When this model of centralization is merged with a NFT marketplace, you run the risk of losing NFTs you’ve created or collected. Centralized marketplaces are typically backed by an organization or company, which means it has full access to the data and assets you provide. This could lead to potential censorship, data tampering, de-platforming, and lack of NFT mobility. As they strive to become major NFT exchange outlets, centralized exchanges have certain key advantages as well as some downsides.

Although only very few NFT marketplaces are completely decentralized, the rest have varying degrees of centralized control. For example, OpenSea, the current leading NFT marketplace, is mostly centralized with certain aspects of decentralization. Despite hosting some of these decentralized aspects, for the most part, it has the ability to restrict projects or individuals in cases it deems necessary.

Pros of Centralized Exchanges over Decentralized Exchanges

Because of their potential scale and resources, centralized exchanges enjoy a number of distinct advantages. Some of these benefits will be crucial in determining whether or not these existing behemoths succeed in the NFT industry.

Custody

An advantage and disadvantage of centralized exchanges is asset custody. These tools help retail traders avoid losing their assets or being locked out of their accounts due to forgotten passwords. This would not be possible in a decentralized exchange, as the platform will have virtually no access to users’ info. Essentially, centralized exchanges aid in the prevention of common blunders that anyone might make when transferring cryptocurrency. However, not your keys, not your coins, meaning once you give up custody of your NFT, the owning party now has the ability to do whatever it wants with the asset.

Partnerships & Intellectual Property

Large organizations like Disney are more likely to partner with established companies like Coinbase that can offer lawful contracts versus permissionless and decentralized protocols. Besides, centralized exchanges are likely to have a competitive edge of collaborating with existing intellectual property and guaranteeing that commissions go through their platforms.

Pros of Decentralized Exchanges over Centralized Exchanges

Despite some of their advantages, centralized exchanges aren’t always better than decentralized exchanges. There are a few advantages permissionless decentralized platforms have over their centralized counterparts. Let have a look at some of them

1) Asset Variety

The most important quality of every marketplace is liquidity. Permissionless protocols, or even alternative exchanges, may be able to list a larger number of NFT assets and do so more quickly. When combined with potential regulatory concerns about specific NFTs, permissionless NFT protocols may have a distinct edge when it comes to accumulating liquidity, whether via cash-flowing NFTs or fractionalized NFTs.

2) Integrations

The composability of smart contracts and software is one of Ethereum’s defining characteristics. Yearn vaults may be used easily by Alchemix for yield generation, and InstaDapp can permit a one-click transfer of collateral from one lending protocol to another (e.g. Aave to Compound). Liquidity is driven to platforms by these types of interfaces and secondary applications. Decentralized markets, unlike Coinbase, FTX, or other centralized NFT marketplaces, will have a simpler time integrating with other protocols due to their open nature.

Depending on your needs, it may be better to use a centralized or decentralized exchange. However, if you truly want full control over your assets, decentralized marketplaces are the obvious way to go (although, the risks are in your hands instead of the hands of a potentially liable third party).